This is the third post in our blog series on the new tax incentives for investment in Australian Early Stage Innovation Companies (ESICs). In our first post we gave a general overview of the key features and objectives of the tax changes. For the second post of our series we took a deep dive into startups, exploring the implications of the new legislation for founders. Check out these posts first if you’re interested.

The legislation changes introduced for investments in ESICs are available to all types of investors, regardless of their preferred investment method. The two key incentives are a tax offset of 20% and a capital gains tax (CGT) exemption for investments of between 1 and 10 years. In this post, we’ll step through these two incentives in the detail.

Who is eligible?

All investors are able to access these tax incentives, but there are some restrictions to encourage the right behaviour from investors qualified to receive the benefits:

Investor Entity - investors are able to invest through their preferred investor entity

a) Corporate Entities but not widely held companies (or their subsidiaries)

b) The tax benefits will pass through Trust and Partnerships (including SMSF)

c) Individuals receive the benefit to claim against taxable income with some restrictions

Individual Investors - non-sophisticated investors get a benefit of up to $50,000 p.a.

a) Sophisticated Investors can claim a 20% offset on up to $1m of investment in ESICs

b) Non-Sophisticated Investors are entitled to the offset but can only invest up to $50k p.a.

c) Non-Sophisticated Investors investing more than $50,000 in a year lose the entire benefit

Residency - an investor entity’s residency won’t affect the tax benefit

What are the limitations?

The tax offset is designed to encourage new investment in ESICs rather than merely subsidise existing investment. Eligibility for the tax offset is based on income year when the shares were issued and is based on the following criteria:

• Newly issued – only investment in recently issued equity is entitled to the offset

• Equity only – any funding with a debt nature is not entitled to the benefit

• Convertible securities - eligible only when converted to equity

• Not a part of an Employee Share Scheme

• No related relationships or affiliate of the ESIC

• Less than 30 percent equity interest

Investments satisfying the above are likely to be able to be offset by eligible investors.

What’s Changed?

Under the old regime investors in ESICs received no direct benefit via an offset and would only receive only a 50% CGT discount if their shares were held for greater than one year.

The current legislation amends the Income Tax Assessment Act 1997 (ITAA 1997) to encourage investment in the newly defined ESICs by providing qualifying investors funding such companies with a tax offset and a capital gains tax (CGT) exemption for their investments.

These amendments introduce a non-refundable carry-forward tax offset for qualifying investor entities equal to 20 per cent of the amount they paid for qualifying shares:

• 20% of the investment in an year can offset tax liabilities

• Investment limit of $1.0m (i.e. the offset is capped at $200k)

• No affiliates of the ESIC are permitted to use the offset

• Non-refundable with no benefit for an entity without any tax liability

• Able to carry forward any unused benefits to subsequent years

The CGT exemption has the following characteristics:

• Shares held for less than 12 months are not included in the regime

• Shares held for 1-10 years get the CGT exemption

• Shares held for more than 10 years receive the exemption for only the first 10 years

There are also roll-overs that may apply under certain circumstances.

Examples

To round out this post, we’ve put together a few examples to show the difference investment return between the old and new tax regimes.

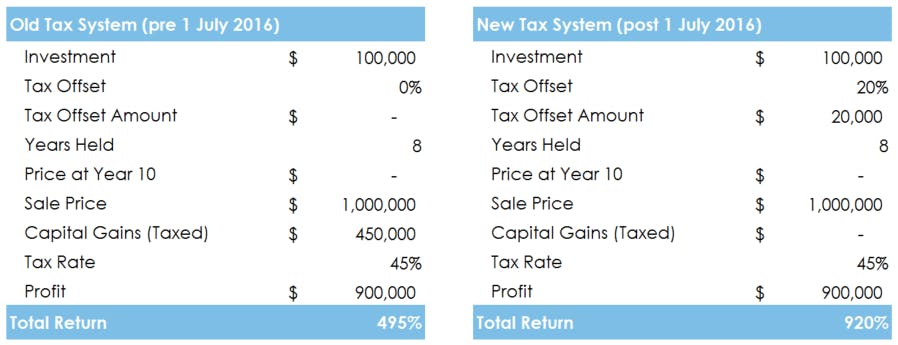

Example 1: Medium-Term ESIC Investment

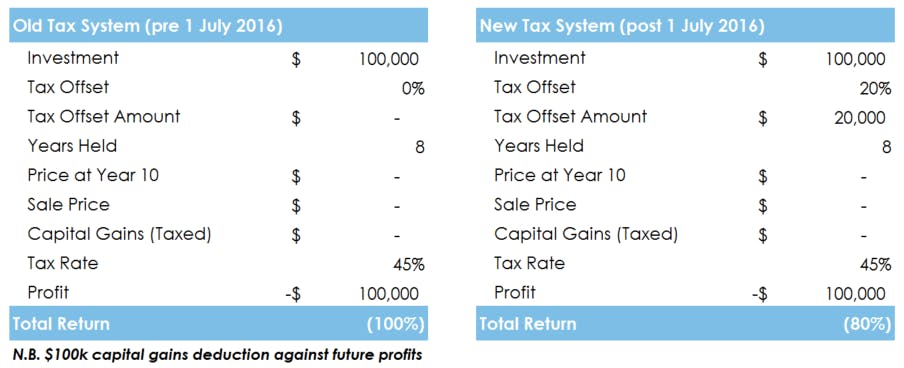

Example 2: Failed ESIC Investment

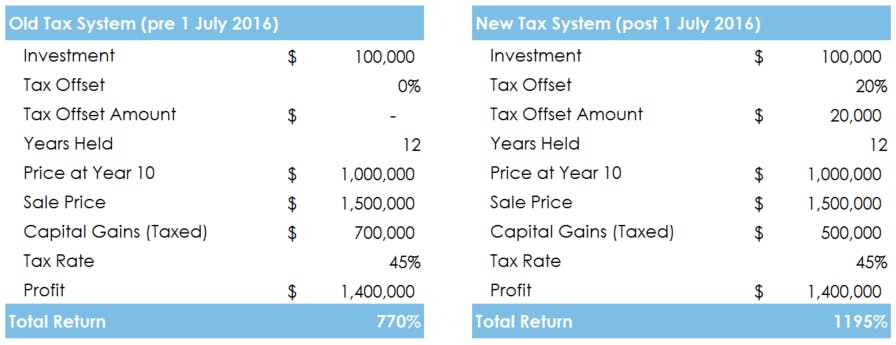

Example 3: Long-Term ESIC Investment

That’s all from us on the new tax rules for startup investment. Feel free to give us a shout if you have any queries or thoughts you would like to share on the new legislation.

The above is based upon the views of Equitise and does not represent formal tax advice.