Modern equity crowdfunding is a finance game changer.

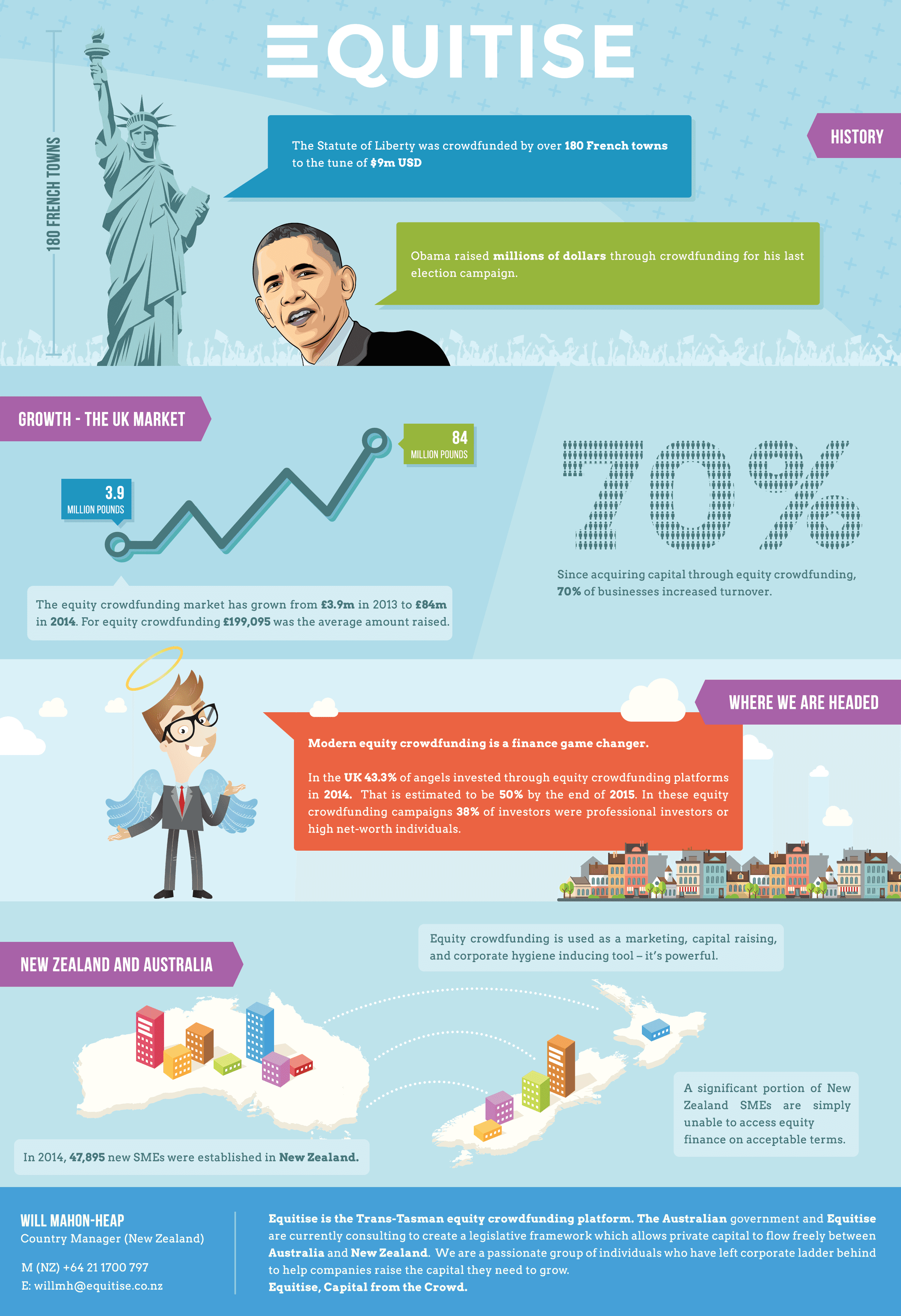

Previously, small and medium-sized businesses struggled to access capital under traditional funding models. New Zealand, along with UK and the Netherlands, were first movers to bring in legislation unlocking the potential of sourcing funds from the crowd. Equity crowdfunding, is experiencing the highest industry growth in the UK at 410% between 2012 and 2014. The most striking revelation coming out of the UK is the effect equity crowdfunding is having on angel investment. In 2014, 43.3% of angels made their investments on an equity crowdfunding platform, this likely to increase to 50% this year.

Back on our home turf, equity crowdfunding platforms such as Equitise are helping Kiwi and Australian businesses access the capital they require to grow and improve, and providing investors access to the early stage business arena. In a recent Business Operation Survey, Statistics New Zealand found that the single largest hurdle to innovate for New Zealand businesses remains meeting the costs of development and market entry. Furthermore, the study found that c.15% of small businesses were unable to access equity capital on acceptable terms. This, coupled with almost 50,000 new SMEs established in 2014, is providing great demand for alternative finance streams such as equity crowdfunding.