Previous blog posts from Equitise

Latest blog posts

Historical Blogs

September 29th 2024

for-companies

Breaking Down the Benefits of Equity Crowdfunding

There are numerous benefits of Equity Crowdfunding that make it an incredibly exciting industry compared to traditional investment opportunities. Equity Crowdfunding is democratising investing, making the investment in startups and early-stage businesses accessible to all whilst simultaneously offering an alternative route to raise capital for businesses looking to scale and grow. We've broken down below some of the top benefits to Equity Crowdfunding for both investors and companies raising.

September 11th 2024

success-stories

Equitise IPO Breakdown and Performance

An analysis of our five most recent IPO performances.

September 10th 2024

for-companies

What is Equity Crowdfunding?

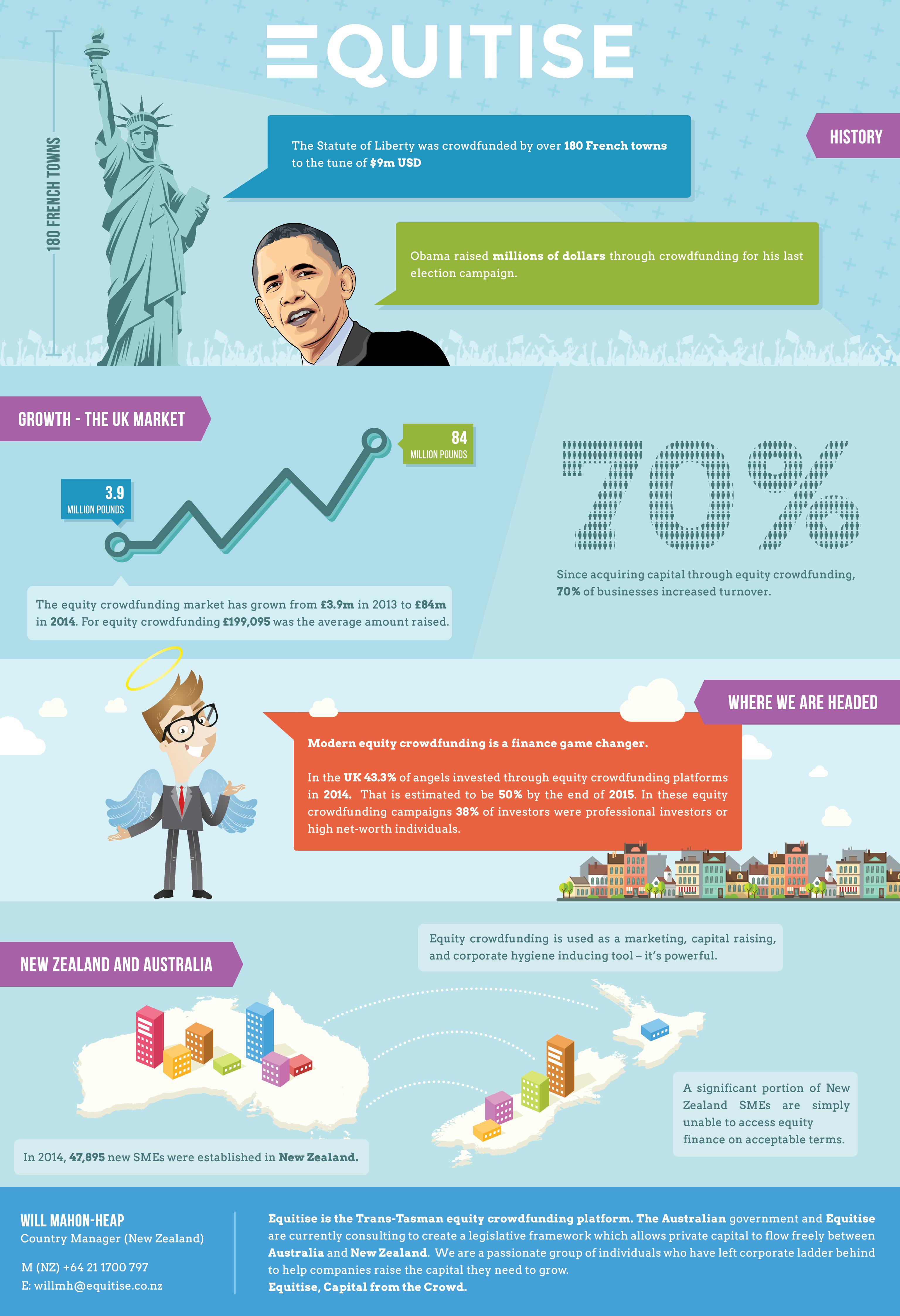

Equity Crowdfunding is the process whereby everyday investors can invest in early stage businesses in return for equity (shares) in that business. The UK pioneered Equity Crowdfunding through legislation introduced in 2011, New Zealand passed the legislation in 2014 and the US in 2016, but it took Australia until September 2017. The first platforms received their crowd-sourced funding license (CSF) from ASIC several months later, in January 2018, with Equitise being among the first. Previous to this change, only wholesale investors could invest in unlisted businesses. Now any Australian citizens over 18 years of age (retail investors) are eligible to invest in unlisted companies.

July 25th 2024

for-investors

Earning A Return With Equity Crowdfunding

How do I make money from a private company investment? Aside from the other benefits of investing in startups and early-stage businesses, we understand that visibility on how you make a return is still key. There is uncertainty when it comes to making money from any investment in a company but even more so with ones not yet listed on the stock exchange. This is because equity crowdfunding investments are relatively ‘illiquid’ (meaning you can't easily sell your shares) so a return can’t be made until what we call an ‘exit event’ occurs whereby you can sell your shares. However, high school economics teaches us that with greater risk, comes greater returns, generally. It’s the same principle here. Early-stage investing in startups is usually seen to be riskier than investing in more established businesses as there are a lot more unknowns however because you’re getting in on the ground floor, there has the potential to be higher returns.

July 18th 2024

trends-and-insights

An interview with Reebok's co-founder

Equitise Managing Director Jonny Wilkinson sits down with Reebok co-founder Joe Foster

July 4th 2024

success-stories

tbh Skincare proves fruitful for investors

Disrupting the adult acne industry

June 25th 2024

for-companies

The Capital Raising Process for Companies

The Capital Raising Process If you’ve just submitted your application to raise with Equitise, congratulations! That’s a great step in what could be a very rewarding and beneficial stage in growing your company. Here we’ll discuss the next steps in our process so you have a better idea of what to expect in the coming days.

May 21st 2024

.jpg?ixlib=gatsbyFP&auto=format%2Ccompress&fit=max)

success-stories

Fractel sprints to success maxing out their raise

Premium, performance running hats and apparel

April 9th 2024

success-stories

Nature's Help natural approach entices investors

Created For Women By Women

March 5th 2024

for-investors

Face your Fear of Investing: What to avoid and what to look out for when investing

There is something about the world of investments that makes it look untouchable and incredibly dangerous. It might be the emotional fear of failure or the very rational fear of losing money. But equally, investing holds a lot of potential and opportunity and is one of only a handful of things you can do to increase your income, something which is a key objective for many investors. The only real way to minimise the risk, and therefore the fear, is to thoroughly understand the cause and effect of the investing decisions we make. So whether you’re looking to make your first investment, or have already built up a portfolio, we’ve listed below our 7 top tips to help you face your fears, and start investing today!

February 16th 2024

success-stories

FTN Motion's capital raise drives in investors

The ultimate urban electric motorcycle

January 10th 2024

for-investors

Investing in an Equity Crowdfund with a Self Managed Super Fund (SMSF)

*Before investing please seek independent advice on whether it is permissible for your SMSF to invest in CSF (crowd-source funding) offers. If you wish to invest in a company on Equitise using your SMSF, you can do so easily as part of the investment process. Your documents will need to be verified by our team which may take a few days, however, you can still go on to finalise your investment while this is pending. After clicking ‘INVEST NOW’ on the offer of interest, you will follow the usual steps on how to invest until you have signed the terms of the offer. It is at this point you will get the option to invest with your SMSF by clicking the toggle next to ‘Invest as a Company, Trust or SMSF’ to the right as shown below.

December 20th 2023

success-stories

Vitable turns subscribers into shareholders

Making feeling good an everyday thing.

November 27th 2023

success-stories

Investors come together to help fight food waste

Farmers Pick offers a sustainable solution to unwanted produce.

November 8th 2023

success-stories

By Manu serves up over $400k from its new shareholders

Founded by Chef, Manu Feildel, By Manu's offers fresh, preservative-free sauces.

September 1st 2023

for-investors

Who Can Invest

Equity Crowdfunding was created to make investing in private companies accessible for everyday people. While Equity Crowdfunding is a very inclusive investment method relatively speaking, there are still some restrictions about who can invest in different types of offers and how much each type of investor can commit.

August 22nd 2023

for-investors

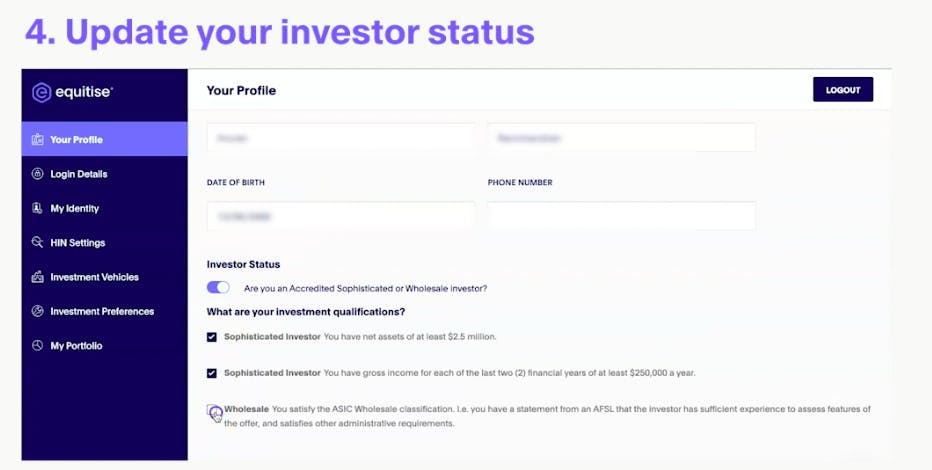

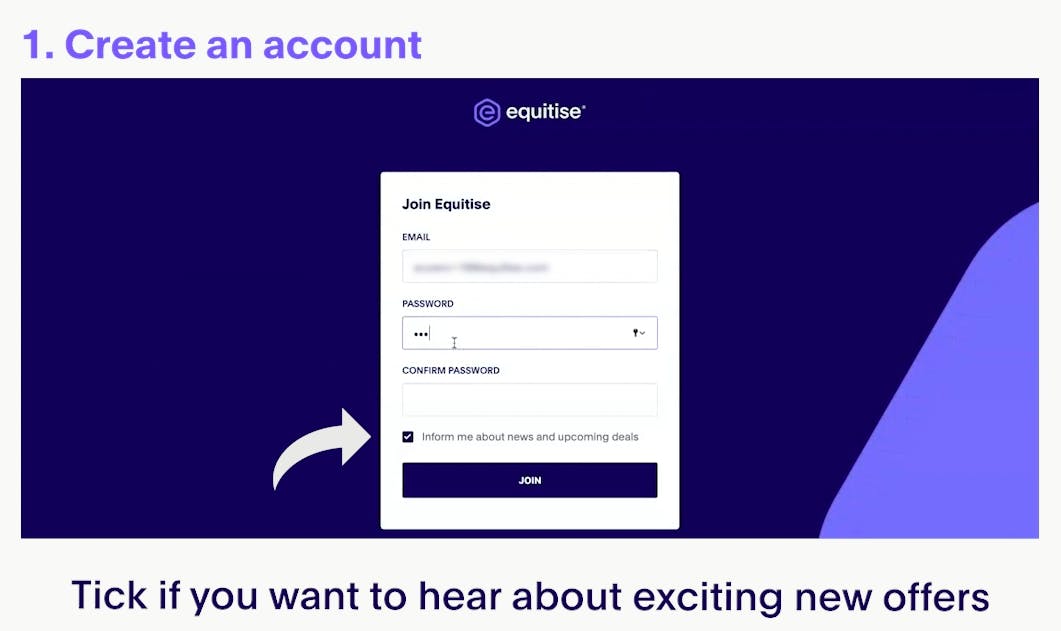

How to Invest: Your Step-By-Step Guide

Investing in an innovative early-stage business on Equitise is super simple and only takes minutes.

June 27th 2023

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)

for-companies

Mastering the Art of Seeking Investment from Close Networks for Your Equity Crowdfund Campaign

Securing investment is a critical milestone for start up founders, as it provides the necessary capital to fuel growth and scale your businesses. When it comes to seeking investment, tapping into your close networks can be a strategic approach. Friends, family, and acquaintances who know and trust you can become valuable sources of funding. However, it's essential to approach these connections in a professional and effective manner to maximise your chance of success. As part of your Equity Crowdfund campaign, we highly recommend you leverage these close networks for the ‘VIP’ investment phase to build some pre-funding before the campaign is opened more broadly. Pre-funding is an important aspect of the campaign and can even dictate the success of a raise. We leverage the pre-funding that companies secure to drive momentum in the raise right from the start, giving confidence to those who have expressed interest in the business ahead of investing. In this blog post, we'll explore 7 key strategies for asking for investment from your close networks. 1. Prepare and Refine Your Pitch: Crafting a compelling and concise pitch is crucial before approaching anyone for investment. Take the time to clearly articulate your business idea, its unique value proposition, market potential, and your plans for growth. Refine your pitch by practicing it repeatedly, incorporating feedback, and ensuring that it resonates with your target audience. A well-prepared and confident pitch will instil trust and increase the likelihood of attracting investment. 2. Clearly Define Your Funding Needs: Before reaching out to your close networks, determine the specific amount of funding required and the purpose it will serve. Outline how the investment will be used to accelerate business growth, develop products or services, expand market reach, or hire additional team members. By providing a clear breakdown of your funding needs, potential investors will have a better understanding of how their support can contribute to your success. 3. Identify the Right Timing: Choosing the right moment to approach your close networks for investment is vital. Making a financial investment, particularly a large one, will often require some lead time, so be sure to factor this in. It is useful to plant the seed at least a few weeks before you need them to invest, and be clear with timelines, so that when you do reach out they’re primed for the conversation. Opt for a time when they are more likely to be receptive to your request, noting that there might be several follow ups required after your initial meeting to get them over the line, and allow for this in your timeline. 4. Personalise Your Approach: When seeking investment from close networks, remember that you're dealing with individuals who know you personally. Tailor your approach to each person, highlighting how their support can make a meaningful impact. Emphasise shared values, common interests, or prior experiences that can create a personal connection and inspire confidence in your venture. Show that you genuinely value their involvement and are seeking a mutually beneficial partnership. 5. Present a Well-Structured Investment Proposal: Develop a comprehensive investment proposal that includes a clear executive summary, detailed business plan, financial projections, and potential return on investment (ROI). Your proposal should demonstrate your understanding of the market, competitive landscape, and potential risks, while also highlighting your unique advantages. Provide realistic timelines for achieving milestones and, where applicable, an indication of the exit strategy for investors. 6. Be Transparent and Manage Expectations: Honesty and transparency are essential when seeking investment. Clearly communicate the potential risks involved in investing in a startup, along with your plans to mitigate those risks. Manage expectations by discussing realistic growth projections, potential challenges, and the possibility of a longer return on investment timeline. Building trust through open and transparent communication will establish a strong foundation for a long-term investor relationship. 7. Follow up and Show Gratitude: After presenting your investment proposal, follow up with each potential investor to answer any questions or concerns they may have. Be proactive in providing additional information, scheduling meetings, or arranging discussions with your team. Regardless of the outcome, always express your gratitude for their time and consideration. Maintain the relationship even if they don't invest, as they may provide valuable feedback, referrals, or become investors in the future. By following the above steps you will get the campaign off to a solid start with great momentum, giving the rest of the campaign the best chance of success. With these steps in place, you’ll be confident and well-prepared to secure the investment you need to fuel your startup’s growth and achieve your business goals. To find out more about raising capital through an Equity Crowdfund, complete our enquiry form here or email [email protected].

June 19th 2023

.jpg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)

success-stories

Savic Motorcycles rides away with $1.2M in equity crowdfunding!

June 5th 2023

success-stories

Zhik sails away with $2M raised

Sailing apparel brand Zhik partner with Equitise to raise capital from both their Australian and international database.

May 3rd 2023

trends-and-insights

Grocery Industry Spotlight

Sam Wood (Equitise Investment Associate) breaks down the recent shifts seen in online and in-store grocery, and what investors should look for in 2023 and beyond.

February 22nd 2023

success-stories

Bushbuck's strong community backing raises over $1m!

New Zealand business, Bushbuck raise with Equitise to fuel them conquering the Australian market.

February 22nd 2023

success-stories

Investors climb aboard Deckee

Deckee raise funds with Equitise as they look to global expansion.

February 21st 2023

success-stories

ReadiiTel Return for $1m+ Raise!

ReadiiTel return in 2022 for their second raise ahead of their intended IPO.

February 16th 2023

trends-and-insights

Apparel Industry Spotlight

Starting with the bold assumption that most readers wear clothes, Sam Wood (Equitise Investment Associate) breaks down the key drivers of growth in the apparel industry, and what investors should look for in 2023 and beyond.

January 20th 2023

trends-and-insights

Equitise 2022 Year in Review

2022 was a massive year for us here at Equitise. We hired some fantastic people, worked with some inspirational businesses…and hit a few new PB’s! Although many of us are already knee deep into 2023, we just wanted to take a final moment to reflect on 2022 and share with you a little of what we got up to.

November 15th 2022

success-stories

Urban Plant Growers Raise $1m to empower indoor food production

UPG successfully raised over $1m with Equitise allowing them to expand into new markets and focus on product development.

September 12th 2022

success-stories

Monday Distillery closes Australia's largest non-alc CSF raise

Founders, Sam & Haydn, are one of the first to pursue the Australian Non-Alc RTD market!

August 23rd 2022

success-stories

Akasha Brewing Co raise $1.75m from 545 investors!

To fund their 5 year growth strategy, Akasha Brewing Co partner with Equitise to successfully raise $1.75m!

June 21st 2022

success-stories

Hero Packaging Raise $1.5m to Fuel Global Expansion

Leader in sustainable packaging for e-commerce brands hits its maximum raise target.

May 16th 2022

success-stories

Forcite Close $6m Series A Led by Uniseed

The Australian smart helmet technology company partnered with Equitise to successfully raise $1,304,695 from 531 investors. Overview In February 2022, the smart motorcycle helmet creator, Forcite, successfully closed a Series A round of $6m led by Uniseed. The round was supported by existing investors, and a $1.3m CSF raise through Equitise. This raise continues Equitise’s strong track record in the D2C, e-commerce space following successful raises with TBH Skincare and Tint. The funds from this equity crowdfund will help Forcite to focus on product development, establishing distribution channels across Europe and scale up manufacturing of their new MK1S helmet to meet a waitlist of over 13,000 customers. What is Forcite? Forcite has created a mass-produced smart motorcycle helmet with EU/Australian safety standard certification, patented visual alerting system, integrated camera and audio technology. Born out of the personal experience of founder Alfred Boyadgis, the team are leading the sector globally with game-changing technology delivering greater safety to riders. Forcite has achieved strong traction having shipped almost 1,380 smart helmets in Australia, and registering interest of over 13,000 individuals. Approximately 50% of these customers are Australian, and over 21% coming from the US, which provides a massive market opportunity as the company expands production capability. Within the global motorcycle market of USD 278 billion in 2020, consumers are rapidly opting for private mobility mode, with two-wheelers becoming a preferred choice owing to their affordability and convenience during COVID-19. Based on industry analysis, the global market is estimated to exhibit growth of 6.87% in 2022. Key Investment Highlights Rapid traction and market validation To date, Forcite has sold almost 1,380 helmets across three controlled releases, with their last release selling out in under 35 minutes. Having a unique and innovative design that addresses rider demand for quality, comfort and advanced technical ability, Forcite’s helmets have grown in popularity through word of mouth and private riding groups run by customers, establishing a strong community of loyal customers. Strategic partnerships driving scalability, distribution and sales Having partnered up with a leading helmet manufacturer, a Tier 1 motorcycle brand, industry experts and with Government support, Forcite has already built out the production line and quality control framework resulting in achieving a high quality product. Clear growth roadmap across verticals As part of the next phase of growth, Forcite is scheduled to release four new styles of helmets and their very own modular on-bike/in-bike computer vision/lidar/radar system that will communicate directly with the helmet. From developing commuter-styled motorbike helmets to racing helmets, Forcite will continue to be a competitive differentiator. Team, advisors and investors The Founders have 28 years of combined experience in technical design and commercializing products. They are supported by a dedicated team of software and hardware engineers along with advisors and production experts who have joined the shared vision. But more importantly, throughout the raise we saw the supportive community of motorbike enthusiasts, ready to invest and follow Forcite’s journey from the beginning. Building a community of fans, not just customers Forcite has built more than just a smart helmet motorcycle company, they have built a lifestyle brand that speaks to its audience. Through their community events, riding groups, social media groups they have built a core group of customers keen to transition to shareholders and co-owners. Key Takeaway from this Raise The raise demonstrates how institutional forms of capital work seamlessly alongside equity crowdfunds. Bringing on capital from VC/Private Equity and raising via an equity crowdfund are not mutually exclusive. In fact, more mature markets such as the UK demonstrate that these forms of capital work alongside each other regularly, serving very different purposes. As the Australian sector matures, we will continue to see more regular examples of this.

April 27th 2022

success-stories

Take a bite out of Chief! Bespoke, hybrid approach for Chief’s $1.3m Seed Round

Funding Round: Seed Total Round: $1,262,817 (CSF + Wholesale Investors + Existing Investors) CSF Portion: AUD $457,817 Total investors (CSF): 233 Average Investment (CSF): AUD $1,965 Overview In March 2022, “better for you” snack brand Chief successfully raised a Seed round of nearly $1.3m. This included support from existing investors, new wholesale investors, as well as a portion from CSF investors; a great example of Equitise helping to orchestrate a fundraise using different pools of capital (all at the same valuation of course!), for a bespoke result. This raise continues Equitise’s strong track record in the food and beverage space, and is another example of success working with a “mission-led” consumer brand. The funds from this equity crowdfund will help Chief increase brand awareness and build their strong community through marketing spending and sales & marketing hires. Chief will also use the raised funds for product expansion, and growth to new geographies, including the US. Who are Chief? Launched in 2015, Chief is a fast growing “better for you” snacking brand made up of the core Chief beef bar/ biltong and collagen bar range (80% revenue) and a complementary collagen brand, Beauty Food. The brand is sold across direct-to-consumer online (currently majority of sales) and wholesale channels in Australia and internationally. They are present in major retailers such as David Jones, IGA, BCF and Harris Farm, as well as gyms and fitness groups including Barry’s Bootcamp. During the campaign, Chief also successfully converted a trial with Woolworths and will be rolling out to 200 stores in May 2022 as a starting point. At the time of launch, Chief had an ARR of $1.6m, set to hit $10m by the end of 2023. Around 20% of online revenue is coming from customers on a monthly subscription. Importantly for emerging brands, the Company had a near term path to positive EBITDA (by mid 2022). This was due to growth marketing spend to date focused on building community around the brand, and new packaging suppliers going forward. Launched in 2015 by Brock Hatton and Justin Babet, alongside Libby Babet (health expert, author and former trainer on Channel 10’s “The Biggest Loser”) and Veronika Larisova (nutritionist and ultra marathon runner), the founders have used their passion and expertise to build Chief into the brand it is today. Within the c.$98bn global healthy snack market, consumers are moving away from big food companies with their perceived healthy snacks which are actually full of artificial ingredients and/or sugar. Consumers are instead looking towards alternative, “purpose led” brands which use genuinely healthy and sustainable ingredients. Investment Notes Why We Liked The Opportunity We first met Justin in late 2020 after reaching out when we saw a growing community online around the highly-marketable brand. We had also seen previous success in the “better for you” food space, with Food to Nourish. Challenger food brands have a great track record in crowdfunding both for investors (many of the best exits and returns have been in this space) and the brands themselves (the marketing and community building benefit is huge). HUGE target market, ripe for disruption We recognised the potential for growth in the c. $98bn global healthy snack market (growing at 6% pa), and saw Chief’s products as being a real disruptor in the Australian snacking space. Working from home in lockdown, we at Equitise team saw ourselves snacking more frequently or replacing proper meals with snacks, but often snack bags and bars aren’t as healthy as perceived. With sugar-filled snacks lining the shelves of most Aussie supermarkets, we expect to see a continuation of the big shift towards challenger, “purpose-led” brands which use genuinely healthy and sustainable ingredients. Unique, “Purpose-Led” Brand… We recognised Chief’s mission-led branding as one of its key highlights and key to building its loyal community of customers. As well as innovating and striving for genuinely healthy snack foods, the founders put great emphasis on sustainability of their Australian supply chain, which we viewed as especially important given they are beef-based. Justin and team are avid supporters of the “Regenerative Agriculture” movement, which is essentially about using a combination of farming practices (some ancient, some modern) that actively regenerates the land, rather than degrading or simply sustaining degraded land. Not only are these practices becoming widely recognised as one of the most important strategies to combat climate change, it’s also winning the hearts and minds of consumers. Through this, Chief also supported the not-for-profit Thankful For Farmers. Founders who have done it before… The first filter for any company we work with is the people: the founders’ vision, ability and leadership, and the skills and passion of the team who are all on the rider together. In the immediate term, we will be working on a time-intensive fundraise together and going forward we want the company to grow to new heights, do great things and ultimately achieve a liquidity event for investors. We loved working with the Chief team; they had a great mix of complementary skills and were all so passionate about the brand and the community around it. Their advisers were also world-class across the board. What impressed us the most, was that the team have had 5 successful scale-ups and exits between them so far; we can’t wait to see what happens with Chief! Multiple exit opportunities at attractive multiples The “better for you” snack space has seen a lot of attention from both private equity and large food groups, looking to snap up challenger brands. In particular, there are some great examples in meat-based jerky brands in the US in M&A and even IPOs (Stryve). Relevant M&A examples include: Chomps acquired by Stride Consumer Partners (US, Jan 2022, $300m, 3.0x revenue) Openway Food Co. acquired by Five V Capital (AUS, Sept 2021) Kind Bards acquired by MARS (US, Nov 2020, $5,000m, 3.3x revenue) Chefs Cut Beef Jerkey acquired by Sonoma Brands PE (US, Jun 2020) RxBar acquired by Kellogg (US, Oct 2017, $600m, 5.0x revenue) Epic Provisions acquired by General Mills (US, Jan 2016, $100m, 5.0x revenue) As Justin and team scale to a near term $20m target revenue, we see some very attractive exit opportunities for investors. What went well? Support of existing investors / hybrid approach Chief already had a very impressive roster of investors from earlier pre-Seed rounds. These included Ordinary Equity, a leading consumer growth equity fund founded by Alex Cornish and Chief’s Chairman, Gavin Ezekowitz, former Managing Director of Royal Bank of Canada (APAC). Existing investors committed almost $600k into this round, at the same valuation as all Equitise investors. There is no better show of confidence in the Company than the Chairman and existing investors committing in a follow on round. This also shows Equitise’s flexibility to tailor funding structures to suit the needs of the raising company, and draw on our large network of sophisticated and institutional investors. Broad community of customers and fans Chief has built a brand that has been seen by over 4M Australians in the past 12 months. Through the direct-to-consumer online channel, Chief has developed strong customer loyalty and a real sense of community. Investors in Chief ranged from health and fitness fans, to those interested in regenerative farming and involved in the beef industry. Positive newsflow throughout campaign The success of the Woolworths trail, announced during the fundraising campaigns was a great testament to the strength of the opportunity and the speed of the growth. Positive updates during the course of a campaign can really help to get people's attention and accelerate investment. “Equitise was great to work with. From day one we had a team of 4 experienced people supporting us on everything from valuation work to writing our offer document to promoting our campaign via social, advertising, EDMs and more. They provided a large amount of examples for everything which made an otherwise imposing job that much more achievable. It’s tough raising capital at the same time as your day job so the weekly WIP kept me on track and I'd often get texts out of hours as the team worked hard to help us secure some of our bigger investors. We did things a little differently than the norm with a hybrid investment round comprising two tranches, one for existing and significant new investors, and one for crowd investors. Equitise introduced us to some great contacts from their wholesale network. While this approach is probably not suitable for everyone, it ultimately delivered us a fantastic result beyond our stretch target.” - Justin Babet, CO-Founder & COO, Chief Nutrition Looking Ahead We are excited to follow Chief on their journey to expand operations and become one of one of Australia’s leading health food snack companies. Since completing their raise with us, they are focused on their rollout across Woolworths stores, and their wholesale channel which will be the key driver of growth. Once we’ve established ourselves in major retailers in Australia, we will shift focus to other international markets including the US, Asia and Europe with the goal of being a global business. New product launches will also feature in the growth plan. They will look to raise a Series A at the end of 2022 so we look forward to working with them again!

April 21st 2022

success-stories

Bundlfresh Offers Investors Sustainable Growth in the Last Mile Delivery Segment!

The Australian online marketplace Bundlfresh partnered with Equitise to successfully raise $1,000,000 from 217 investors. Bundlfresh aims to use the funds to expand its services across Greater Sydney, and continue on its mission to ‘make shopping local a big advantage’. What is Bundlfresh? As large grocery chains invested heavily into online shopping and convenience, many smaller independent, local retailers have been unable to participate meaningfully in this digital channel. Founded in 2019, Bundlfresh is an Australian online marketplace allowing consumers to bundle produce from their favourite local stores, butchers, bakers, greengrocers, delis and more, into a single order and delivery. Currently, Bundlfresh serves 47 suburbs across the Northern Beaches of Sydney, and has plans to expand across Greater Sydney Area, and other major Australian cities over the coming years. Why we liked the company Unique Value Proposition Bundlfresh has a unique value proposition for both customers and vendors: enabling local vendors to compete with big grocery chains through online sales; and allowing customers to flexibly bundle any item in a single order and delivery, saving time and money. A Massive Underserved Market Fresh Produce is a $50Bn market and Independent (non-supermarket retailers) have ~30% share ($15Bn). In such a massively underserved market, Bundlfresh is capitalising on the rise of online shopping, and riding off the megatrend of buying local to focus on a $2Bn market opportunity. Strong traction and growth potential In the past two years, Bundlfresh has grown at an annual growth rate (CAGR) of more than 300%, and is now serving 47 suburbs. Since May 2019, more than 120,000 vendor orders have been delivered to nearly 3,000 customers. Sustainable business model Unlike other last-mile delivery services such as Milkrun and Send, Bundlfresh has carved out its own niche with local vendors, and is able to have a clear road to profitability without suffering the intense price competition present in the industry. With strong customer satisfaction, high retention and ‘word of mouth’ referrals, Bundlfresh’s Customer Lifetime Value (CLV) currently sits at $2,825 and its online conversion rate is 18% compared to the industry average of only 3%. Looking Ahead In addition to launching into new regions across Sydney in the coming months, Bundlfresh is has been approached by a Tier 1 Independent Grocer seeking to be onboarded onto the platform. This will see the addition of 10,000 grocery lines allowing customers a ‘full service’ offer beyond fresh produce. With a commitment to supporting local communities and suppliers across Australia, the vendor has expressed an intention to price match Coles and Woolworths on more than 1,200 products. Key Takeaways from this Raise More sophisticated investors in CSF In recent raises, and particularly in this one, we are seeing higher participation from sophisticated investors who are driving up the investment average. With Bundlfresh, we observed a very high average investment of $4.6k vs our avg across most deals of $2.8k. In 2021, 11% of investors are wholesale investors, an increase from just 7% in 2018. This is a continuous trend that we expect to keep seeing as the crowdfunding space matures in Australia. Engagement over size A key contributor to Bundlfresh’s successful raise is its highly engaged audience - both customers and vendors. With hardly any marketing spend to date, the company's growth to over $3m in annualised revenue has come nearly entirely from word-of-mouth referrals. With 500 of its 3,000 customers having ordered more than 15 times, the company has built a platform with sticky and passionate customers with many jumping at the opportunity to invest. Whilst many other companies we have come across have had much larger databases to which they could market the offer, Bundlfresh's was unique in its 'stickyness'. This is a key thing for companies to consider when they are considering a CSF, and drives the likelihood of converting customers into investors.

March 30th 2022

success-stories

Fast-growing Aussie e-commerce brand stirring up how we paint & decorate

Tint has raised $700,000+ within 2 weeks of launching, to fuel growth plans!

March 18th 2022

trends-and-insights

Industry Spotlight - E-Commerce

How many of us have ordered something online during lockdowns last year? E-commerce, the buying and selling of goods and services over the internet, has accelerated through COVID, growing at 57% over the last year alone! Supported by adoption and improvements in e-commerce services and technologies such as Shopify and Afterpay, Australia has seen a further shift online by traditional retailers, growth in online marketplaces as well as emergence of digitally-native, direct to consumer (“D2C”) brands. Concepts such as same-day delivery, that were once unheard of in Australia, are now commonplace thanks to improvements in delivery and logistics infrastructure and systems. Whilst the growth is impressive, Australian e-commerce activity is currently only ~16% of overall retail, compared to 20% of total retail in the US market. Here at Equitise, we predict that we will continue to see a shift online, fuelling fundraising activity in online-only startups, as well as complementary businesses such as packaging, payments or supply chain technologies. This convenience of online shopping has had a tremendous impact on the way we shop. Focus on the customer experience, distinctive branding and a subscription revenue model all create customer loyalty. Whilst COVID accelerated this trend, the real winners in the long term are those with an evergreen customer base and strong unit economics. E-Commerce has also been fuelled by the proliferation of online content across all media platforms such as Youtube, Instagram and TikTok, or the growth of the “creator economy”. This has accentuated a new form of marketing and selling products or services online, in a way that engages a ‘fan-base’ of customers. As e-commerce continues to dominate global markets fuelled by the COVID pandemic, it is time to take a look at why online and in particular, D2C businesses have boomed, and the key trends we look out for. The Australian E-Commerce Landscape As we emerge into a future led by spending more time at home, more and more Australians have shopped online than ever before in 2021. E-commerce has taken off in Australia with total revenue from the online shopping industry valued at $44 billion, as of the end of 2021. As Australian consumers have had no choice but to change their online spending habits, this has driven a dramatic shift in online shopping behaviour. As a result of the COVID-19 pandemic, this trend highlighted total online sales to have grown by 12%, as of June 2021, where businesses are rapidly ramping up digital sales capabilities. Despite the common trend towards rising e-commerce penetration globally, online spending in Australia has remained consistently below most international markets. But, as international players have entered the Australian market this past year, penetration has doubled in the last 5 years due to the impacts of COVID, reaching 13%, as of the beginning of 2021. We explore the key players: Hybrid Model: Existing retail brands transitioning to online. Driven by enforced lockdowns and a shift in consumer buying habits, many well-known Australian retailers have accelerated their online expansion. Technology has allowed established retailers to leverage their physical stores and distribution networks to meet customer expectations by offering “click-and-collect” services and home deliveries. For example, Woolworths is one of Australia’s earliest online innovators, particularly with the online offerings of Big W, Dan Murphy's, Cellarmasters and Woolworths. Holding a c.10% market share in online shopping in Australia, Woolworths have successfully expanded and streamlined its delivery options and click-and-collect services during the pandemic. To further cater for online demand, Woolworths launched an online marketplace, ‘Everyday Market’, in September 2021, a one-stop-shop for all everyday essentials, ranging from Health & Beauty to Pet Needs. Other retailers such as Bunnings, Myer, BWS, Coles, David Jones, Freedom and Harvey Norman are also transitioning to provide more efficient services online. Online Marketplaces: Aussie Home Grown Successes Australia has also had its own share of home grown e-commerce success stories, ranging from B2B and B2C marketplaces across fashion, homewares and trade supplies. These include Catch.com (founded 2011), The Iconic (founded 2011), Adore Beauty (founded 1999), Grays.com (current format founded 2000) and Kogan (founded 2006). These have evolved the Australian buying experience, disrupting traditional business models and taking increasing market share from bricks and mortar retailers. COVID accelerated this disruption, as retail stores had to close and shoppers had to look online. "We're definitely seeing a transformation in terms of how people shop.. E-commerce in Australia has advanced several years in the space of a few months…We will continue to take more market share. People are shifting because they see how easy it is. They don't have to find a parking spot and deal with a pushy sales assistant. People have changed the way they shop. We are seeing it across the board.'' Ruslan Kogan, quoted in the AFR Online retailers are continuingly tapping into a range of features such as managing delivery options (click-and-collect or home delivery), customer email services, and personalised apps and website experiences, to consistently engage with their growing online customer base. International Marketplaces Alongside the home grown ecommerce platforms, Australia has also seen the entry of global ecommerce powerhouses, including eBay and Amazon. eBay entered the Australian market in 1999, and alone is used by 12 million Australians on a monthly basis to shop and sell goods online. Amazon, entered later in 2017, but has already hit $1.2 billion sales (as of Dec 2021), and is forecasted to account for approximately 25% of the Australian online retail sales. They remain a strong competitive force in the Australian market, providing the consumer with more options to shop online. Digitally Native & Subscription Brands Another category is online-only platforms that focus on a specific category or product and drastically disrupt the buying experience for the customer. Given the relative nascency of e-commerce in Australia, this often includes categories disrupted in more mature markets and then approached here in Australia. Koala was one of the early movers in the Australian direct-to-consumer movement, targeting the outdated and user-unfriendly experience of buying mattresses and furniture. Taking this a step further, for more perishable goods such as groceries, toiletries and toilet paper, D2C brands can operate on a subscription basis. This creates recurring revenue and customer loyalty for business and increased convenience, personalisation and improved experience for the customer. Some examples include: Lyka, subscription premium dog food (raised $6.5m in July 2021) Who Gives a Crap, toilet paper with purpose (raised $41.5m in September 2021) Eucalyptus, subscription telehealth/ healthcare products (Series B raise of $30.0m in July 2021) D2C and subscription businesses are becoming increasingly competitive with increasing costs of marketing and customer acquisition as consumers have more choice. Focus is therefore on increasing customer LTV and growing and keeping a strong user base. This comes down to building a strong community of fans around a brand and superior customer experience. The Supporting Acts: Complementary service & technologies. Supporting the boom in online retail is a breadth of players covering the full infrastructure chain from funding of ecommerce business models, cloud services, payments technology (such as Shopify), logistics/supply chain management and packaging & last mile delivery. On top of this there are also technologies driving the customer experience including digital and behavioral marketing and customer insight companies. These are seeing huge growth, a range of examples from the past 18 months: Sendle, delivery and logistics for SMEs (raised $20m in Jan 2019) Carted, application programming interface (API) tool for online businesses (raised $13m in May 2021) Clearco, revenue-based financing for E-Commerce brands, raised $215m through a growth equity round, in July 2021 Particular Audience, an Aussie E-Commerce startup, that focuses on machine learning technology, raised $7.5 million in Series A funding in November 2021 Here, at Equitise, we are seeing some great investment opportunities in this space, for example, Hero Packaging, which is launching a fundraise in March 2022. Finally there are also complementary services for consumers. For example, one of Australia’s latest tech unicorns (and current target of a huge acquisition from Square), Afterpay, is an installment payment service provider that enables its customers to buy products on a ‘buy now, pay later’ basis. Most Interesting Trends in Australian E-Commerce As more and more Aussies resort to online shopping measures, the growth of e-commerce has propagated across both metropolitan and regional areas in Australia. Spending more time at home than ever before, we continue to see phenomenal growth in the e-commerce industry. Here, we will discuss key trends that have been witnessed this past year. Lockdown habits are here to stay. COVID-19 has changed the way Aussies approach the online marketplace. Due to the convenience of browsing products online and efficiency of home-deliveries, the e-commerce market will see sustained growth, even after the pandemic. In the ABS Household Impacts of COVID-19 Survey, one-third of respondents indicated they prefer to shop online now more than they did before the pandemic. So, how is Australia’s e-commerce increasingly catering to new online shoppers? In 2021, 1.36 million Aussie households made an online purchase for the first time. With COVID-19 restrictions closing non-essential services, Aussies took to shopping online, surging sales for online retailers. More importantly, these restrictions had a significant impact on how often Australians shop online. According to Australian Post’s eCommerce Industry Report 2022, those who made a purchase less than four times between March and December in 2020, 52% shopped online more frequently in 2021. Bricks and mortar retail is not done yet! During the pandemic, an increasingly familiar experience for many Australians included visiting different online and physical stores, browsing and comparing competitive prices online, and choosing the most convenient way to get the products they need and want. This resulted in Australian omni-channel online expenditure to grow by 71.6% from 2019 to 2020. Omni-channel retail involves consumers combining physical and online channels, often within the same purchase journey. For example, a customer may search for a product in-store (physically or online), pay for it online but pick it up at a store (including through ‘click and collect’ or ‘curbside pickup’), buy online or buy through a peer-to-peer or social media platform and have it delivered to their home. As a result, businesses must consider their omni-channel strategy to deliver a convenient shopping experience across channels. Buying online still means buying local. According to a study conducted by Shopify, 47% of consumers value the local presence of brands from which they shop from. The ‘buy local’ trend gathered momentum during the height of the lockdown, further perpetuated by Australia’s natural disasters and economic upheaval, to show support for local Aussie businesses in remote areas. With the help of social media campaigns urging Australians to shop in local communities, attention turned to these communities to reinvigorate the local economy. #ClickforVic was a powerful campaign launched by the State Government, designed to support local businesses. During the height of the Victorian lockdown, this hashtag received traction through 31,000 posts! Other such hashtags included: #BuyFromTheBush #SpendWithThem #WhereYouShopMatters #BuyRegional This noticeable uptake in social media campaigning allowed regional businesses to promote their businesses for free via these campaigns, allowing Aussies to support the local businesses they wanted to see encouraged. Crowdfunding and E-Commerce Equity crowdfunding allows startups to raise significant funds from a wide range of investors instead of relying on an angel investor or other restrictive investment channels whilst building a community of brand advocates. This in turn helps these startups build brand awareness and loyalty which is key to the success of any business. We have recently been working with some exciting ecommerce brands, such as Tint (D2C Paints and Interiors) and tbh Skincare (D2C Skincare) as they look to scale in Australia and internationally. In 2022, we predict more fundraising in activity in sectors supporting the e-commerce infrastructure, such as Hero Packaging, which creates sustainability. Conclusion The Australian e-commerce landscape is constantly evolving, adapting to new consumer preferences and behaviours that have been forever changed, even as we look beyond COVID. As e-commerce continues to grow, we predict Australian penetration to increase to levels seen in the US or UK. The role of supporting infrastructure, what we call ‘picks-and-shovels’ businesses, such as packaging companies to online website development platforms, will become more vital than ever in supporting e-commerce businesses. To reach this growing base of online consumers, equity crowdfunding becomes a great way to connect retail investors with the consumer brands they buy from or use. Feel free to reach out and get involved! If you are a D2C brand and are considering fundraising in 2022, reach out to the Equitise team and we can walk you through how a process might look like. Equally, if you are an investor looking to own a share in our next D2C, e-commerce raise, reach out to us and keep an eye on your emails!

February 23rd 2022

trends-and-insights

Industry Spotlight - Craft Beer

First, in the series of blog articles on the Australian drinks industry, we explore the craft beer phenomenon and why our investors love owning shares in the hottest craft beer brands… Key Takeaways The craft beer industry in Australia growing at 10% CAGR, represents an almost a billion dollar industry, and still has room to grow when compared to markets such as the US and UK Growth drivers include the continued experimentation of styles, the push into taprooms, growth of low/ no alcohol and potential international expansion Crowdfunding and craft beer work well together; all its about engaging a community around a product and passion Australia has recently seen some record-breaking craft beer fundraises (Batch Brewing, Spinifex) including in non-alcoholic beers (Sobah, Heaps Normal) We see continued activity in the space, as well as broader infrastructure Introduction In spite of years of strong growth and some impressive exits, the craft beer revolution in Australia is still on an upwards trajectory and there’s never been a better time to get behind your favourite craft beers. The story of how the craft revolution began is well known; beer-lovers turned home-brew enthusiasts experimenting with their own flavour combinations and brewing methods and evolving into small-scale and low volume breweries. The result? Unique and innovative flavour combinations and styles, using local ingredients and traditional brewing methods. Craft beer in Australia is now almost a billion-dollar industry, with up to 1,000 breweries nationwide (although some value the wider industry at over $2bn, given the high labour intensity and employment). Craft beer is now part of mainstream culture, with events such as GABS100, seeing huge press attention and following. Whilst some of the larger craft breweries have since been acquired over the past decade (including Stone and Wood last year), there is a tail end of independent breweries building communities around beers — the essence of the craft movement. In a market where drinking in moderation is favoured, a combination of heavy marketing spend by the corporate-backed craft beer brands (we won’t get into a debate whether that still makes them craft…) and a loyal following from fans of the independents is driving the strong market growth in the craft beer segment. That said, the market is still in a relatively early stage (c.14% craft beer revenue penetration out of the total beer market, 10% of volume) versus more mature markets such as the US (c. 24%). This article covers some of the main themes in the Australian craft beer landscape and what Equitise looks for in its record-breaking fundraises for craft beer brands. The Craft Beer Landscape in Australia Traditionally, the Australian beer market has been highly concentrated and largely produced for local taste and consumption. The major players in the industry include Asahi (owners of CUB), Lion Nathan (owned by Kirin) and Coopers. Whilst overall beer consumption in Australia has declined in recent years, the demand for independent beer brands is increasing, and craft beer continues to take market share. There are a number of craft breweries owned by larger groups, including multinational drinks companies and craft beer groups operating multiple labels such as Mighty Craft. Whilst they are able to capture most of the retail shelf space and on-premise tap space, they are also bringing in new enthusiasts to craft beer through big marketing budgets and awareness. As uniquely different brands, they serve to bring new enthusiasts to craft beer…as the saying goes, a “rising tide raises all ships”. The continued growth of craft beer is characterised by passionate craft beer makers and home brewers, together with more discerning beer drinkers and consumers who are demanding a more distinct, flavourful and higher quality product. This has increased focus on drinking for flavour and authenticity as well as “drinking local” and building personal relationships with preferred brands. The trend is evident in a long term shift in consumer tastes, which is driving an expected increase at a CAGR of up to 10% going forward. Craft brewing is all about experimentation and smaller, independent breweries are nimble enough to quickly work with new and different styles, raw materials, recipes and flavours. Indeed, there is a huge range of styles and flavours for consumers. Fruited sours, session IPAs and XPAs are popular go-to's in the craft space, with an ever-increasing demand for ‘sessionable’ beers, including the growing ‘no and low’ alcohol trend. Equally, high quality, independent versions of classic styles such as lager are seeing strong offerings from craft brands like Hawke’s, Yulli’s and White Bay. During the COVID-19 pandemic, the industry has faced unprecedented challenges as the forced closure of retail outlets, pubs and restaurants limited sales channels for many breweries. As home consumption rose sharply, there was a shift to long-standing value beer brands, as well as a major swing to beer cans (vs bottles). The pandemic emphasized the importance of having strong distribution channels, including an online presence. Nevertheless, the IBA grew in membership over the course of the last year, and with a supportive regulatory environment (such as the increase in excise rebate last year), the number of breweries looks set to increase further. Looking ahead we see 3 key themes shaping the industry… Trends Driving the Growth of Craft Beer 1. Continued expansion into venues Expanding into branded and proprietary venues, including brewpubs or taprooms, allows craft beer brands to build awareness, strengthen their customer loyalty as well as being a higher profit margin route to market. With crowded off-premise shelves and competitive tap space in on-premise locations, proprietary venues allow craft brands to showcase new releases as well as get closer to the customer, creating an easier, less intimidating experience. Peter Phillips, the former Chair of Independent Brewers Association (IBA) recognises this and says: “The growth of indie brewers is testament to the fact that consumer demand is driving growth … Australians want greater connections to community, to the people that make beer and to their local meeting places.” This will also drive beer tourism in areas with several breweries or those of particular standing that can attract visitors from afar, such as in Marrickville in Sydney or around Hahndorf in South Australia. 2. No and low-alcohols A broader moderation trend and the ‘better for you’ movement is driving demand for low carb, low calorie, gluten free and also low and no alcohol options. It is telling that in January 2022, Heaps Normal broke records by coming in at #20 on the GABS 100 countdown, as the first no/ low alcohol beer to do so. The category is certainly booming, according to the 2021 IWSR Drinks Market Report, ‘no and low’ alcohol volume is expected to grow by 16% between 2020 and 2024, with a study revealing 71% of Aussies intend to increase or maintain their no- or low-alcohol consumption this year. Other brands such as Nort (Modus Operandi) and low alcohol beers such as Brick Lane Brewing’s Sidewinder, a low ABV hazy pale ale, are also doing exceptionally well. 3. Taking Australian craft beer global Mirroring the arguable success of other Australian beer exports such as Fosters, Australian craft beer is ready for the global stage. Currently, the industry has a low export rate (around 5% of sales) primarily because relatively few of the brewers have achieved the scale to make export cost-effective and more mature markets such as Uk and US already have homegrown beer brands with local presence. However, there is a huge potential opportunity to export, in particular to Asia Pacific. For example, Mountain Goat (backed by AB InBev) has been exporting to Asian markets for over 5 years, and Moondog, the Melbourne based craft brewer, has also opened up a venue in Singapore. Spinifex Brewing, who raised with Equitise in 2021, saw export as a big growth channel, and was already shipping to markets in Europe, Japan and South America. Craft Beer M&A Activity Craft beer M&A has been driven by the traditional beer and alcohol players trying to capitalise on market growth and adding brands to their portfolios, in a trend that has been seen in other markets such as the US and UK. In Australia, multinational alcohol giants such as Carlton & United Breweries (owned by Asahi) and AB InBev have made a number of acquisitions of successful craft breweries including Balter, 4 Pines, Pirate Life, Green Beacon and Mountain Goat. These transactions typically see attractive multiples paid to buy up the culture and ethos of smaller brands that the big players can’t create themselves, such as the beachside community identity of Balter, founded by 4 professional surfers including Mick Fanning. Whilst there are many critics of such transactions, the marketing and distribution benefits bring an overall net benefit to the craft beer movement. In Sept 2021, Lion (owned by Japanese multinational, Kirin) paid more than $500m for Australia’s largest independent craft brewer — the Byron Bay-based Fermentum, parent to brands including Stone & Wood, Two Birds and Fixation. This shows even the biggest craft brewer has a suitor and can be convinced to give up its independent roots for a price!

January 27th 2022

success-stories

Successful Crowdfund Exit: Car Next Door

Campaign Year: 2017 Campaign Type: AU - Wholesale Campaign Duration: 69 days Amount Invested: A$770,000 Number of investors: 24 Average Investment: A$32,678.67 Percentage Funded: 156.9% What is Car Next Door? Car Next Door is an online peer-to-peer car-sharing platform operating in four cities, with 50,000 members sharing 1,200+ vehicles. The company lets Australians access cars on demand, without the costs and upkeep associated with ownership. Access to cars is secure and unattended through a patent-pending method utilising an electronic lockbox with a plug-in GPS tracker and an online booking and payment platform. Rapid growth since an early pilot scheme in 2013 has seen Car Next Door become the second-largest provider of car share services in Australia. The Founders of Car Next Door became highly aware that a lot of people own a car but often don’t use it. They wanted to find an environmentally and financially friendly solution by creating a car-sharing platform allowing owners to rent their vehicle(s) to borrowers who need it. The Car Next Door idea is driven by "green motivations" as they work to reduce the amount of carbon emissions released into the atmosphere. One car produces 44.3 tonnes of carbon dioxide over 10 years. An even higher amount of emissions are created during the manufacturing process. The sharing of underutilised cars reduces the number of vehicles on the road. Research also shows that with car-sharing both borrowers and lenders become more aware of the cost of driving so tend to drive less Moreover, the emissions created by Car Next Door borrowers are offset by long-term emission reduction projects run by the environmental not-for-profit organisation Greenfleet. The organisation works to restore native forests and biodiversity in Australia. Having a working and highly scalable platform that was quickly gaining traction, Car Next Door partnered with Equitise to raise A$770,000 from 24 investors, overshooting the initial target by 56.9%. Funds raised were largely allocated to fuel customer acquisition through marketing efforts and enhancing the existing platform, as well as optimising customer conversion, obtaining parking spaces in high demand areas and creating a corporate offering. Quote from Will Davies, CEO at Car Next Door "We have worked with Equitise a couple of times now to support the Car Next Door business in its capital raising strategy. Over both engagements we found the Equitise team to be professional and genuinely passionate in assisting our team yield the results we were looking for. We hope that one day we may be able to utilise their platform to conduct a full retail offer to the public through equity crowdfunding." Investor Exit - Car Next Door gets acquired by Uber It was announced on January 19 2022 that ride-sharing giants Uber had acquired Car Next Door. This means that Equitise investors who participated in Car Next Door's 2018 and 2019 rounds with us were able to get a return on their investment. This acquisition builds on Uber's ongoing investments in electric vehicles, micromobility, and public transportation in order to reduce dependency on private automobiles and contribute to the creation of greener, more liveable communities. Car Next Door will report to Uber's Australian team after the acquisition, but will otherwise operate independently, with its current leadership team focusing on growing and scaling its technology in other cities across Australia.

January 6th 2022

for-investors

Meet the founder of Forcite

Forcite is a technology company that has created a mass-produced smart motorcycle helmet with ECE 22.05 (EU/Australian safety standard) certification, patented visual alerting system, integrated camera and audio technology. The company was born out of firsthand experience, when in 2013, motorbike enthusiast Alfred Boyadgis took a fall going through an oil slick, injuring his knee. It transpired that the camera mount had smashed the side of his helmet compromising the protection to his head. Aside from bolt-on devices not being designed for helmets, the thought did strike him that given modern sophisticated camera, sensor and tracking technology like we see in luxury cars, we should be able to anticipate such hazards. This would allow riders to take evasive action before those hazards become a danger. We had a chat with co-founder Alfred Boyadgis to get to know more about Forcite and its revolutionary technology.

December 24th 2021

for-investors

2021 Year in Review

We’ve wrapped up another record-breaking year at Equitise, and what a year it has been for both us and for equity crowdfunding in general! We thought you might like to hear a little bit about our biggest moments — so here goes… This year we broke the Australian record for the largest craft beer raise not once, but TWICE. Across the border, we saw two Equitise alumni, Greenfern Industries (GFI) and Tradewindow (TWL) complete successful listing on the New Zealand Stock Exchange (NZX), representing strong returns for our investors. In 2021 we have also seen our Equitise family grow. We welcomed a bunch of new members including Ben on the fundraising team, Al on the marketing team, and Lisa, our new graphic designer. We’re also excited to welcome three new interns who will be joining us early next year! Read on for a full breakdown of 2021 at Equitise.

November 29th 2021

.jpg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)

success-stories

D2C fresh food disruptor Your Food Collective raises $644k

Female-founded fresh-food disruptor Your Food Collective successfully raised over $644k from 232 new investors last month. With aims to reach $28m in FY24 revenue, YFC plans to use these funds to grow the commercial operations by expanding their product range and developing a white label product range that will help to support even more local and regenerative growers.

October 22nd 2021

for-investors

Top 5 Reasons To Invest In Startups

Why Invest in Startups? We’ve all heard the statistic that 90% of startups fail with only 50% of businesses making it past their 5th year. So why invest in startups? In reality, despite carrying greater risk, startups have always presented an alluring investment opportunity for both new and seasoned investors alike. Similar to many financial instruments, in exchange for higher risk, they offer the potential of huge returns.

October 8th 2021

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)

success-stories

Spinifex Brewing Co. Leads Another Record-Breaking Raise

Last month, WA based brewer Spinifex Brewing Co made equity crowdfunding history with Australia’s largest ever craft beer raise, hitting its maximum funding target of $2.0 million in just over two days of being public. This comes off the back of our previous record-breaking craft beer raise with Batch Brewing who raised $1.5 million earlier this year. The raise made regional and national press and television, creating a huge buzz around simultaneous venue and product launches. Spinifex plans to use the funds to support the development of its 24HL Nambeelup Brewery and flagship North Beach Ale House along the pristine WA coast to drive domestic and international growth.

August 5th 2021

trends-and-insights

Why More Female Founders Are Equity Crowdfunding

There’s been a lot of talk in the Australian media lately about the lack of funding for female founders, with many female-led startups looking at alternative sources of capital and steering away from venture capital firms. In particular, equity crowdfunding has risen in popularity amongst startups run by women, allowing them to raise capital with lower barriers to entry whilst also building a loyal and passionate customer base in the process. The numbers are there to show this, with a significant decline in venture capital investment globally for women-led firms. In fact, women-led businesses in Australia and New Zealand only received 5.3% of the $2.7b in venture capital funding in the first half of this year. Furthermore, just approximately 12% of decision makers at VC companies are women, and most businesses still don't have a single female partner. 12% of decision makers at VC companies are women

July 2nd 2021

offer-news

Openly - Improving the privacy standards of Australians everywhere

If you store sensitive personal information on your cell phone or internet provider's servers, as many of us do, there is a very good chance that some organisation, government agency or company will have access to that data. Your privacy is no longer a theoretical risk; it's a reality whose impacts you can see and feel. It's time to take action to improve the privacy standards of Australians everywhere. Australian consumers want greater choice and control, stronger privacy protections, and zero friction. The 2020 Australian Community Attitudes to Privacy Survey showed:

June 24th 2021

for-investors

The Complete Guide To Equity Crowdfunding

This is a complete guide to equity crowdfunding. Learn about what it is, the benefits, how to invest and more. Equitise is the leading equity crowdfunding platform giving you the opportunity to invest in Australian startups and early-stage businesses.

June 18th 2021

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)

trends-and-insights

Top 5 Trends Shaping Fashion Tech Startups

Technology trends are defining the future of how consumer brands interact with their consumers. They provide established fashion brands and emerging startups and entrepreneurs an opportunity to take advantage of new technologies to create unique customer experiences, drive digital engagement, as well as generate additional revenue streams. As one of the biggest industries in the world, it’s surprising to learn that the way fashion operates today hadn’t changed that much in the past few decades until recently. Generating an estimated $1.5 trillion a year, technological innovation in this industry was stalled due to the abundance of low-cost manual labour as a means of reducing pricey production costs. However, nowadays fashion trends are being pushed to the masses faster than ever because of social media, training customers to want instant access to the latest trends. At the same time, younger generations are showing an increased preference for products that are tailored to their specific needs and tastes. This coupled with a more socially conscious consumer base has paved the way for exciting new technologies to disrupt one of the biggest e-commerce sectors. In fact, fashion is the largest e-commerce sector in the world, with a global market value of $759.5 billion in 2021 and expected to hit $1+ trillion by 2025.

June 15th 2021

offer-news

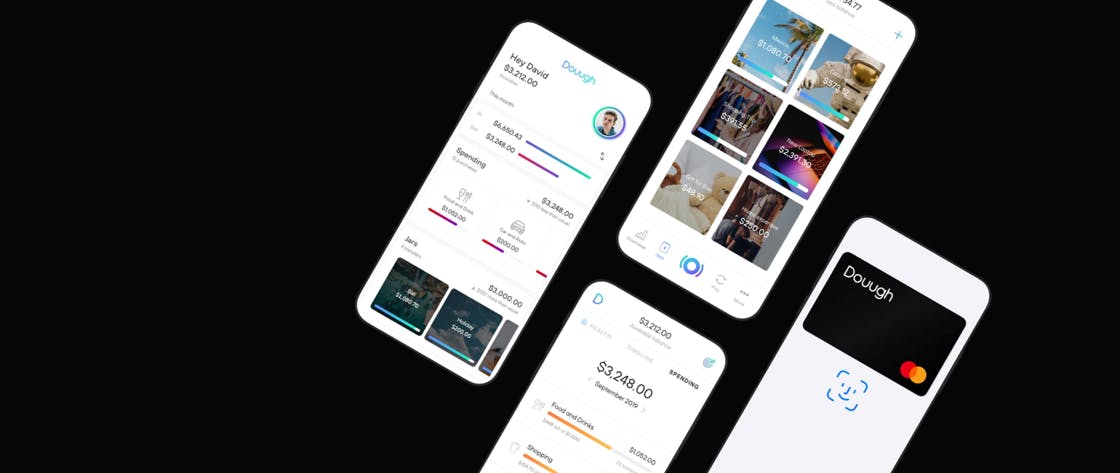

Lumiant - The Future of Financial Advice

The Australian Financial Advice industry is going through significant change. Technology is disrupting the status quo and transforming how financial advice is delivered, and who delivers it. Since 2019, the sector has been shaken by the Royal Commission. Regulatory changes have placed requirements on the industry for true customer-centricity and Best Interest Duty. Where Advisers are required to put the client, not the product, at the centre of advice.

June 9th 2021

offer-news

Here Comes The (Luxury Travel) Boom

Travel fans and adventurers are adjusting to the “new normal”. Folks are beginning to find their way back out onto the open road… even if only for a weekend. They’re making old and new friends, getting out of town for face-to-face socializing and rediscovering their appetite for indulgence. That said,this is still a heavily guarded recovery, and in some parts still socially-distanced. However, as appetite for, and ability to, travel returns, the luxury travel sector is emerging as the most resilient and fastest growing post-pandemic.

June 3rd 2021

for-investors

How to Time the Market

When to buy and when to sell, the two fundamental questions any investor will come across in their investing journey. Timing the market is a problem as old as investing itself, a problem even the most prolific investors, statisticians and researchers have put their minds to. At the end of the day, however, nobody actually knows which way the market will go. There are billion dollar algorithms crunching every data point imaginable, and there are big market makers controlling and influencing prices, yet none actually know with 100% certainty if things are going to go up or down. When it comes to everyday investors, we’re even more disadvantaged than the institutions. There is research you can partake in to improve your odds, but there is no way to accurately predict the future every time! We’ve detailed a few options below to give yourself the best shot. Macroeconomic Factors Macroeconomic factors are broad, economy-wide influences such as GDP, inflation and employment levels. These factors are generally well predicted by government institutions, such as the ABS, and can provide a good indication of where the economy, and thus the markets, are headed. If it’s looking like strong economic growth and smooth sailing, it’s quite likely markets will head in the same direction. However, everything is interrelated and nuanced too. For example, strong economic growth might also cause inflation to rise, requiring central banks to increase interest rates that tend to drive funds out of markets and into bonds. Many smart investors will look for opportunities in crisis, such as at the onset of the pandemic. Those who backed Zoom early were rewarded for this foresight, although so much so that unrelated company Zoom Technologies also saw their share price skyrocket 1800%... The Crowd Another great way to predict the market’s next move is by considering what everyone else thinks. Since markets are just a reflection of the demand and supply of participants, if everyone thinks the market will go up, it probably will! The problem with this approach is how to accurately assess what everyone is thinking. Key press sources such as the Australian Financial Review can provide a good indicator of general mood, but there will always be big money from institutions playing a heavy role in the direction prices go. The weight of opinion is most clearly seen when public figures get involved. With the rise of social media and everyday investors participating in markets, a simple tweet from a figure such as Elon Musk can send a stock to the moon, or crashing down. Other Markets Other markets can provide a fairly empirical source of market prediction. Foreign markets such as the USA’s’ Nasdaq have such a major impact on the global economy that they tend to influence other markets. Most days, the Australian ASX200 will generally go in the same direction as the Nasdaq from the night before. However, this isn’t always the case, especially if there are factors at play that are highly specific to Australia. Playing the Long vs. Short Game Overall, we’re all playing the same game. While short-term movements can be hard to predict, the one thing we can say with near certainty is that the market will go up in the long-run. Through all sorts of peaks and troughs, wars, crises and more, almost every market in a developed economy has gone up over time. Most markets fall between 5% and 10% annually on average, which over a long time horizon equates to quite a bit of compound interest! With this in mind, the best strategy is often not timing the market, but time in the market. The best way to go about this is through dollar cost averaging, which involves investing small amounts at regular intervals over time. So rather than investing $10,000 at once and trying to time the market, you invest $1,000 every month regardless of whether the market is up or down. This allows you to minimise short-term movements and focus on the long-term value of your investment. It’s also a great way to save money! Equity crowdfunding is a longer term investment strategy and less sensitive to the market. Also, by investing in a range of exciting Australian startups, it’s a good way to diversify your portfolio with investment being fee free.

June 3rd 2021

educational-resources

The Stages of a Private Company from Founding to Floating

When speaking about private companies, we often find ourselves using all sorts of industry jargon. To the uninitiated, the financial terminology used when discussing investment opportunities can be confusing and often prohibitive. On top of that, even the most seasoned investors may only have experience limited to one area of finance. Many Australians have at least dabbled in the ASX in some capacity, but very few have been actively involved with early-stage companies. In this article, we go through the full life cycle of a startup, from founding, to hopefully one day floating! Founding A stage most are familiar with but fewer have touched. The founding of a company is the first official stage of an entrepreneur’s journey. Of course, for most, the work would have already started long before the official founding of the company. This might include market validation, research and development, and capital raising. Depending on the company, some founders will need to raise capital before they even get off the ground, such as a technology product a long way from revenue or profit generation. While many are able to bootstrap a business from their own pocket, most founders will need an initial injection of funds to keep the lights on. At this stage, investors will generally have nothing more to invest in beyond the team and the vision. As a result, friends and family are a common source of funds, in addition to angel investors with a keen eye for opportunity. Seed Stage After a young company has gotten off the ground and has started to kick goals, it enters the seed stage of its life cycle. At this point, the company will have made some achievements, and had its fair share of setbacks. It might have an MVP (minimum viable product), a few trial customers, or maybe some pre-orders. Seed rounds are usually when things start to get serious, and the company raises capital in order to execute on all of its preparation and plans. Seed rounds are still considered highly risky, so investors will still be backing a big idea, a strong team, and some early achievements, and will be rewarded by substantial gains should the business make it to the next stage. Capital raised here generally goes towards market entry, final tech development or key hires to help the company grow. Equitise often facilitates wholesale capital raises for companies at the seed stage, and even some equity crowdfunding campaigns where the opportunity is suitable. Growth Stage The growth stage is one of the most exciting times for an early stage company. At this stage, the company has validated its idea, generated some revenue or successfully executed on its initial launch plans. Now it's ready to go full steam ahead with its plans to grow and scale, and can generally attract a wider range of investors now that the opportunity has been derisked sufficiently. Companies in their growth stage will look to spend hard on marketing or in making key hires that can bring some experience to the table in bridging the gap between a startup and a growth company. The company will also have started to make enough noise to attract most institutional investors, like venture capitalists and angels, in addition to presenting an acquisition opportunity for larger incumbents in the market who might be concerned with its progress! Equity crowdfunding through platforms such as Equitise plays its best role at this stage. Series A, B… Many investors would have read about Series A, B, C and onwards rounds in the news for the various private company unicorns in Australia. These letters are simply used to categorise capital raises between seed/growth stages and IPOs. Some companies may only have a Series A round. Others may choose to stay private longer, such as Elon Musk’s SpaceX which is well beyond Series M! These rounds are when private companies begin to raise serious capital from large, institutional investors from within Australia and further abroad. Hiring and development really start to ramp up and valuations continue to climb. Generally, rounds are large enough that multiple investors will be involved often with a lead investor from a venture capital fund or institution. Pre-IPO For the companies that choose to go public, the first step is a pre-IPO raise. Many investors simply assume that when a company is large enough it will list on an exchange, but this is often not the case. Some companies prefer to stay private, and raise their capital off market. There are a number of reasons to do so, and importantly investors can still see a return through dividends, buybacks, acquisitions and off-market transactions. Listing on a stock exchange is a costly process. This means many companies will need to raise simply to afford the fees involved with going public. Often this is called a bridging round, and might involve a smaller raise from existing investors to allow the company to complete the listing transaction. IPO An IPO, or initial public offering, is where a company floats on a stock exchange such as the ASX. This is a costly and time consuming process that rewards the company with a publicly traded status allowing investors to buy and sell their shares with relative ease. Generally, a company will use a broker or investment bank to facilitate the bookbuild, which is the process of securing investors for the IPO round. There are some more complex ways to list on an exchange without raising capital, but most go for the simple route. Once a company is interested in listing publicly, a wide range of new investors generally become interested due to the increased liquidity. This also often represents an exit opportunity for the very early stage investors. One important consideration is that companies listing on the ASX need at least 300 shareholders. Even more is often recommended, which will allow for healthy trading upon listing rather than having just a few large shareholders. Equitise plays a valuable role in this space, facilitating what is known as ‘retail spread’. Since we have a large database of investors, brokers will often enlist our help to close out an IPO round with a few hundred investors, allowing the company to meet its listing requirements. These companies often have plenty of capital available to them, but simply need a range of investors on the register. Equitise is able to use technology to do so in a far more efficient way than traditional retail brokers. Equitise offers a range of early stage investment opportunities, including equity crowdfunding, wholesale and IPO! The companies we work with for equity crowdfunding are generally doing their Seed, Series A, B and C rounds and can go all the way through to IPO’ing with us. Learn more here.

June 3rd 2021